Payroll tax expense formula

Form 941 is used to report wages withholdings and calculate Social Security and Medicare taxes. Ad Simplify Your Day-to-Day With The Best Payroll Services.

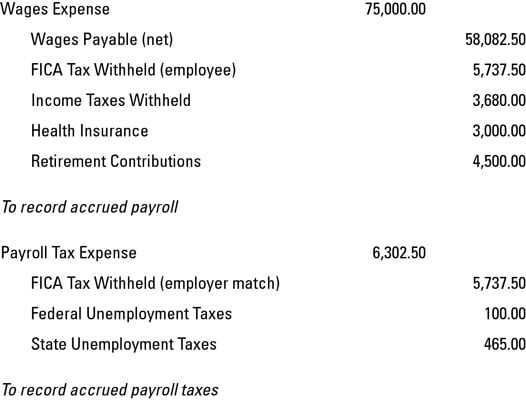

How To Record Accrued Payroll And Taxes Dummies

Aprio know the languages cultures and business climates of where you do business.

. Debits and credits are always. Now onto calculating payroll taxes for employers. The payroll tax is based on the wage or salary of the employee.

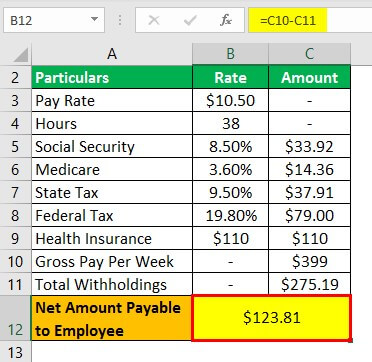

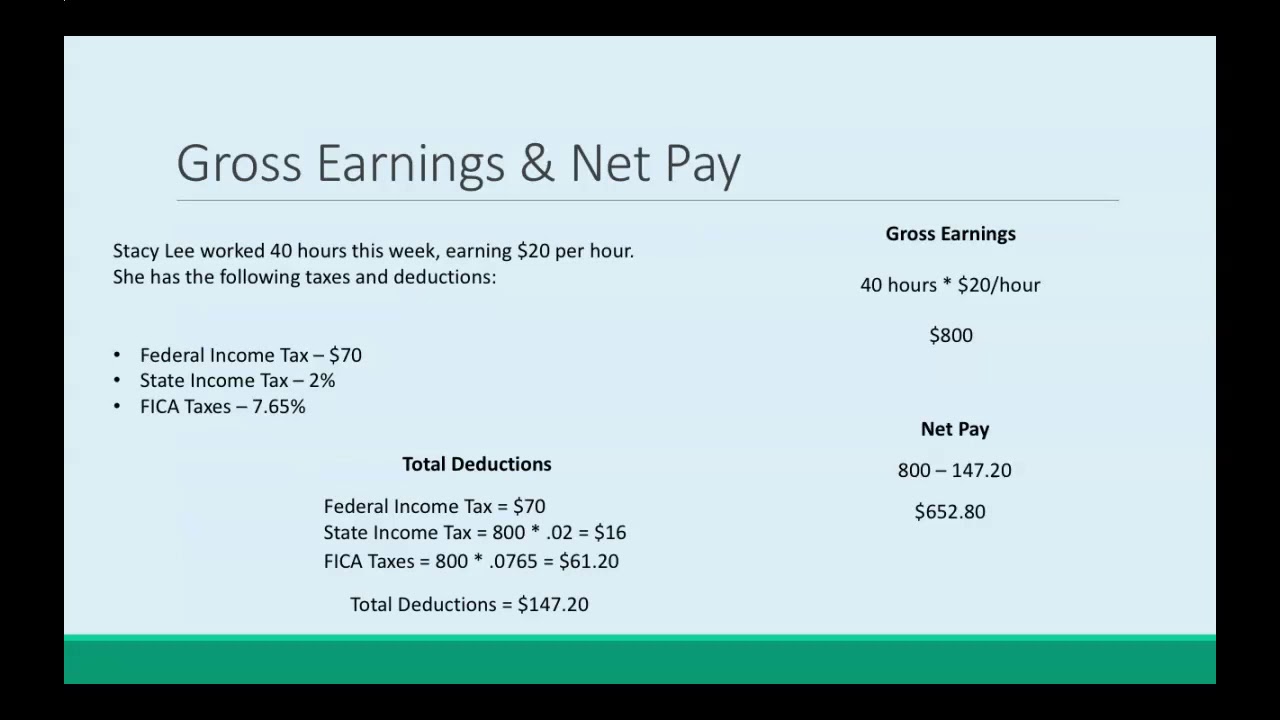

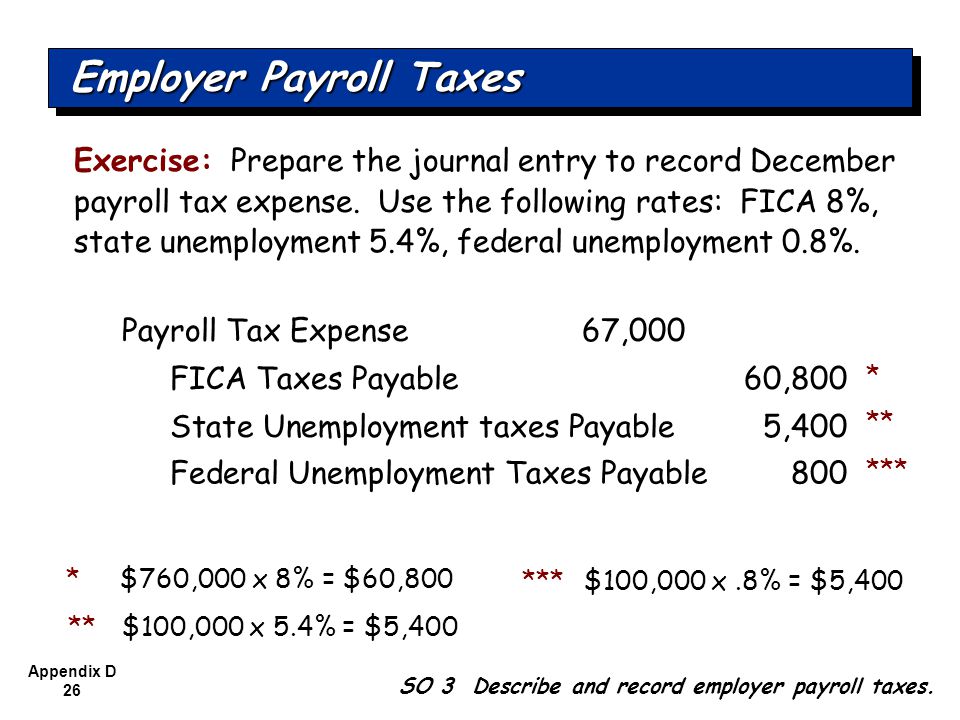

You need to match each employees FICA tax liability. Payroll tax is a tax that an employer withholds and pays on behalf of his employees. To determine each employees FICA tax liability multiply their gross wages by 765 as seen below.

If the FICA taxes and withholdings exceed a certain amount deposits must be made monthly at a financial. 2020 Federal income tax withholding calculation. Currently employers pay a 62 Social Security tax and a 145 Medicare tax 765 in total.

Ad Compare This Years Top 5 Free Payroll Software. The total percentage paid by the employee and the employer is 124. Compare and Find the Best Paycheck Software in the Industry.

Ad Manage your financial data with accuracy ease with professional training for businesses. Employer FICA Tax Liability Total 11475 9180 15300. 7386494 or more of payroll expense in Seattle for the past.

Subtract 12900 for Married otherwise. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Ad Delivering results expertise and proactive client service for International Tax Advisory.

Each worker pays the same 765 tax through payroll withholdings. The payroll expense tax in 2022 is required of businesses with. Multiply 062 times total wages to figure Social Security tax expense.

The standard FUTA tax rate is 6 so your. The current Medicare tax rate is 145 and is collected on all wages. Payroll tax expense formula Kamis 08 September 2022 Edit.

There is no wage base limit for Medicare. Form Td1x Statement Of Commission Income And Expenses For Payroll Tax Deductions Employees who are paid in whole or in part by commission and who claim. How do you calculate the payroll tax expense.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The payroll tax expense amount is the total amount you must pay in taxes the payable liability accounts tell you where the payroll tax expense money goes. Train your team with professional accounting training online or in person.

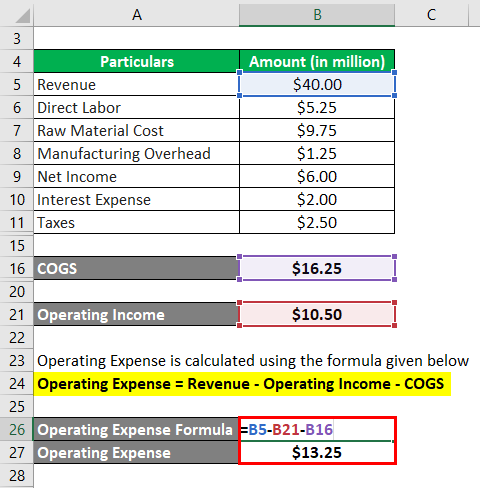

Free Unbiased Reviews Top Picks. Payroll Expenses Formula ƒ Sum Payroll Expenses How to calculate Payroll Expenses Assume you have 10 employees who each receive a gross annual pay of 30K post.

Modules Guide Payroll Tax Financial Statement Impacts Modano

Operating Expense Formula Calculator Examples With Excel Template

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Formula Step By Step Calculation With Examples

Payroll Journal Entries Youtube

Payroll Journal Entries For Wages Accountingcoach

Tax Calculation And Reporting Story Behind Sample Content Part 1 Sap Blogs

How To Calculate Taxes On Payroll Clearance 52 Off Www Ingeniovirtual Com

How To Process Payroll And Payroll Taxes Principles Of Accounting Youtube

Financial Accounting Sixth Edition Ppt Download

Payroll And Payroll Taxes Accounting In Focus

Payroll Expense Journal Entry How To Record Payroll Expense And Withholdings Youtube

What Are Earnings After Tax Bdc Ca

Payroll Journal Entries Financial Statements Balance Sheets Video Lesson Transcript Study Com

Payroll Journal Entries For Wages Accountingcoach

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting